Why Are Implants So Expensive?

According to recent statistics, tooth loss is a prevalent issue, especially among older individuals. Adults between the ages of 20 to 64 have an average of 25.5 remaining teeth. However, factors such as age, smoking, lower income, and education level can contribute to a higher likelihood of tooth loss. In this article, we will explore dental implants in detail through the following aspects:Affordable Dental Insurance: A Budget-Friendly Guide to DHMO vs. DPPO

updated on November 15, 2023

Have you ever struggled to understand the details of dental insurance plans and coverage policies? The options seem endless. Should I go for a Dental PPO or Dental HMO? What's the difference anyway?

This article will help you better understand the folloiwng key aspects:

-

Two prevalent types of dental insurance plan: DPPO vs DHMO and how they work

-

What types of dental care will be covered by DPPO and DHMO

-

The average costs for DPPO and DHMO

-

What's a DPPO plan?

DPPO stands for Dental Preferred Provider Organizations. It's a popular type of dental coverage mainly because of relatively large network of dentists. If you're a member of a DPPO plan, you can enjoy reduced fees for services covered by the plan, as long as you go to dentists within their network. But what if your favorite dentist isn't in their network? No worries! One thing about DPPOs is that they'll still partially reimburse you for dental services you get outside their network. Although, be aware that you might not save as much as you would with an in-network dentist.

Usually, in dental DPPO plans, there is an annual deductible that members are required to meet before they can take advantage of reduced fees for their denal services. A deductible is the amount that an individual must personally pay out of pocket before the insurance coverage begins. It acts as a threshold that needs to be crossed before the dental insurance plan starts contributing to the cost of the services.

Some DPPO services have a repeat clause. For instance, if you get a filling, but for some reason, it fails. If you need it replaced, the plan might not cover the cost unless a specific number of months have passed since the initial service.

While DPPOs give you the freedom to choose out-of-network care, remember that dentists can charge more than what the insurance allows. That could mean you'll end up paying more out-of-pocket. Tip to avoid surprise out-of-pocket costs: Have your dentist submit a Pretreatment Estimate or Pre Determination to the insurance company on your behalf. This way, you'll know in advance what you'll be expected to pay.

What's a DHMO?

DHMO, or Dental Health Maintenance Organization, is a good option for individuals or families looking for affordable dental coverage. Dental HMOs ( DHMOs ) tend to have lower premiums but less flexibility. Member of this plan must choose from a list of in-network dentists, which is a major difference from DPPOs.

DHMO plans usually have no deductibles or maximums. As soon as you're enrolled, your coverage kicks in without the need to meet any initial payment threshold. But you need to pay some copayments for non-preventitives procedures at a flat rate. The plan provides you with predictable costs with a set pay rate for various dental services. No need to worry about upfront out-of-pocket expences.

One significant limitation of DHMO insurance plans is their narrower provider networks. Often, these networks aren't as extensive as the wide-ranging options you'd find with PPO plans. Without an out-of-network option, you might find yourself traveling longer distances to visit a dentist, and chances are, it might not be the one you're accustomed to seeing.

DHMOs and DPPOs May Cover The Following:

Basically, the coverage structure follow the mode of 100/80/50 for different dental services:

-

Preventive dental care: Both plans covers 100%. Preventive dental care includes cleaning, oral exams, certain types of X-rays, and fluoride treatments.

-

Basic dental services: Or named basic restorative in the detailed plan. Normally, both plans will cover a flat fee rate at around 80% for these services. But for DPPO plans, you will need to meet your deductible before the insurance coverage kicks in.

-

Major restorative services: For major services, like crowns, bridges, dentures and implants, coverage percentage varies, but often 50% of the costs.

-

Average Costs:

Dental insurance premiums vary greatly based on geographical location, individual dentists, and several other determinants. The pricing structure is influenced by factors such as plan types, insurance providers, and the coverage levels. Monthly premium rates for individual coverage typically range between $12 and $50. Notably, Dental Preferred Provider Organization (DPPO) plans often fall towards the higher end of this spectrum. On average, Dental Health Maintenance Organization (DHMO) plans command monthly premiums of approximately $22.75, while DPPOs command a relatively elevated average of $62.75 per month.

Conclusion:

Choosing between DHMO and DPPO plans ultimately depends on your individual needs and preferences. With DHMO plans, you can enjoy the convenience of no deductibles, and the assurance that preventive dental services are covered at 100%. However, be prepared for varying copays with different procedures. On the other hand, DPPO plans come with deductibles, and while preventive services are fully covered, you may encounter out-of-pocket costs for basic and major procedures, with coinsurance ranging from 20% to 50%. Additionally, the absence of an annual maximum in DHMO plans provides peace of mind, while DPPO plans typically have an annual maximum ranging from $1000 to $2000.

It's essential to factor in your budget and expected dental needs when considering these costs. As you navigate the choices, weigh the benefits against your priorities to make an informed decision that suits your oral health and financial well-being.

free&low-cost dental clinics

View Now

dental health

Dental Implants

Dental Implants

Will Your Insurance Cover Dental Implants?

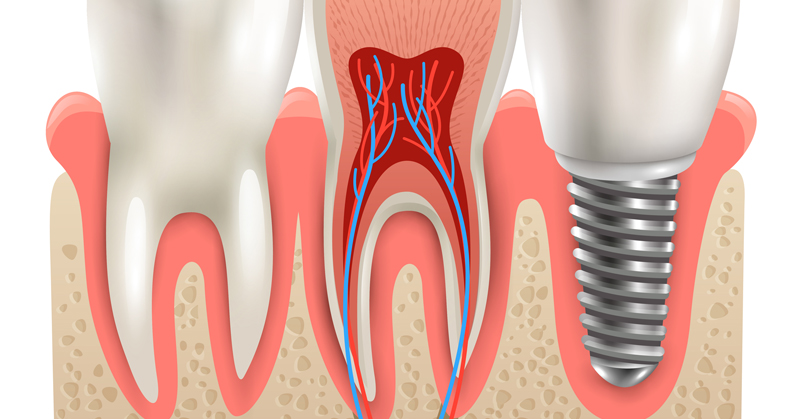

Dental implants are growing in popularity, with over 3 million Americans choosing them to replace missing teeth. While implants fuse securely into the jawbone providing natural-looking and long-lasting tooth replacements, the process does come with a hefty price tag. On average, a single implant can cost $1,600-$2,200 out of pocket. For patients needing multiple implants or other restorative work, these expenses quickly add up.

Dental Implants

How to Find Dental Implants for Low Income

Dental implants are popular and effective solutions for replacing missing teeth. However, they can be quite expensive. For instance, one single implant can cost about $1500 in the US.If you're looking for ways to make dental implants more affordable, this article will provide you with five practical strategies to save on cost.

Dental Implants

Do You Know All These Different Types of Implants?

In the field of dentistry, dental implants have revolutionized the way we approach tooth replacement. With their durability, functionality, and aesthetic appeal, dental implants have become the go-to solution for individuals with missing teeth. However, not all dental implants are created equal. There are various types of dental implants, each with its own unique characteristics and applications. In this comprehensive guide, we will explore the different types of dental implants and the techniques used for their placement.

Dental Implants

Top Dental Implant Brands in the United States

When it comes to dental implants, finding a reputable and reliable dental implant service is crucial. Dental implants are a popular and effective solution for replacing missing teeth, providing individuals with improved aesthetics, functionality, and oral health.With the increase in demand for dental implants, numerous brands have emerged, providing a variety of options to meet the diverse needs and budgets of patients. Choosing the right dental implant brand is vital as it directly affects the success and longevity of the dental implant procedure. In this article, we will explore some of the top dental implant brands in the United States, known for their expertise, advanced technology, and exceptional patient care.

Dental Implants

What Are the Possible Risk Or Side Effects for Dental Implants?

Dental implants provide an excellent way to replace missing teeth and restore your smile. But as with any medical procedure, there are possible risks and side effects to consider before undergoing implant surgery. In this article, we aim to provide a comprehensive overview of dental implants - what they are, who is a suitable candidate, and most importantly, the potential risks and complications that can arise. By understanding both the benefits and possible downsides of implants, you can make a fully informed decision about whether they are the right choice for your individual needs and health profile.