Why Are Implants So Expensive?

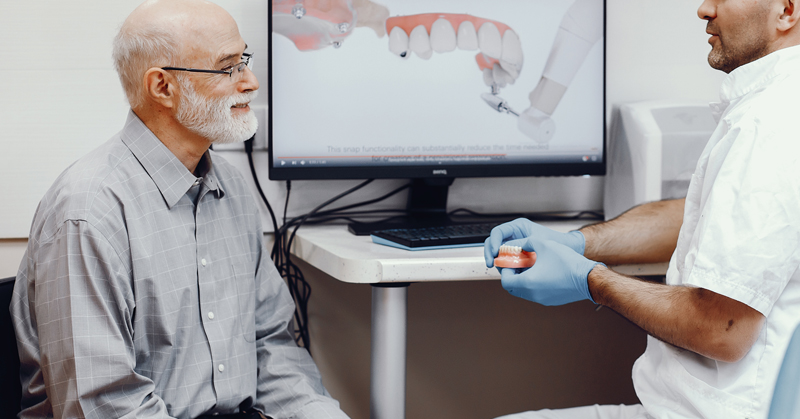

According to recent statistics, tooth loss is a prevalent issue, especially among older individuals. Adults between the ages of 20 to 64 have an average of 25.5 remaining teeth. However, factors such as age, smoking, lower income, and education level can contribute to a higher likelihood of tooth loss. In this article, we will explore dental implants in detail through the following aspects:How to Select the Best Dental Insurance for Your Budget?

updated on November 15, 2023

Is dental insurance a worthwhile investment? The answer lies in the strength of its benefits—a robust financial safety net and comprehensive coverage. Particularly valuable is a plan that covers 100% of preventive care, offering a key incentive. Incorporating dental insurance into your health coverage not only enhances financial security but also helps prevent more serious dental issues, ultimately keeping overall medical costs in check.

Yet, finding dental insurance with optimal reimbursement levels and broad coverage can be challenging. This article aims to simplify your decision-making by presenting the best dental insurance companies. We'll assess factors such as average costs, premiums, deductibles, provider networks, and reimbursement levels to guide you in making an informed choice that aligns with your needs.

Comparative Analysis of Top Dental Insurance Providers:

In this part, we delve into the standout features of the top four dental insurance providers, offering tailored recommendations based on key aspects. Whether you prioritize a variety of plan options, affordable coverage, comprehensive benefits, or nationwide accessibility, this guide is designed to help you make an informed decision for your unique dental care needs.

Best for Variety of Plan Options: Humana

-

Average Costs:Offers diverse plans, including some with premiums as low as $0, providing exceptional budget flexibility.

-

Deductibles:No deductibles for preventative care, enhancing accessibility to essential services.

-

Dentists Networks:No waiting period for Preventive Value PPO, facilitating immediate access to dental services.

-

50% discount on certain procedures enhances cost-effectiveness.

-

Policy Limitations:Excludes major procedures like oral surgery, root canals, dentures, and orthodontics.

-

Advice: Humana excels in offering a variety of plans with cost flexibility, making it ideal for those seeking a tailored dental insurance experience.

-

Best Affordable Coverage: Delta Dental

-

Average Costs:Ensures affordability with straightforward monthly premiums and no deductibles for preventative care.

-

Deductibles:Guarantees a deductible-free experience, eliminating financial barriers for routine care.

-

Dentists Networks:Boasts a vast network of 364,000+ dentists, ensuring wide accessibility.

-

DeltaCare USA policy allows immediate access without waiting periods.

-

Policy Limitations:Specific exclusions are not outlined, suggesting comprehensive coverage.

-

Advice: Delta Dental stands out for providing affordable coverage with a comprehensive network, making it a strong choice for cost-conscious individuals.

Best for Benefits Provided: Guardian Direct

-

Average Costs:Presents dental plans starting at approximately $15 per month, catering to cost-conscious individuals.

-

Deductibles:Absence of deductible for preventative care contributes to seamless access.

-

Dentists Networks:Network of 100,000+ dentists offers ample choices.

-

Policy Limitations:Imposes waiting periods for certain services, such as 12 months for implants.

-

Advice: Guardian Direct excels in providing comprehensive benefits, making it an excellent choice for those valuing major dental work coverage and flexibility.

-

Best for Nationwide Coverage: Cigna

-

Average Costs:Provides varied rates based on plan design and additional factors, ensuring options for different budgetary needs.

-

Deductibles:Eliminates deductibles for preventative care, promoting ease of access to essential services.

-

Dentists Networks:Extensive network with 92,000+ dentists ensures nationwide accessibility.

-

Policy Limitations:Exclusions and limitations vary by state, with specific coverage determined by age.

-

Advice: Cigna is an ideal choice for those prioritizing nationwide coverage, offering varied rates and comprehensive access to dental services.

-

Conclusion:

Choosing the best dental insurance requires careful consideration of various factors, as evidenced by diverse customer experiences with different insurers like Humana Dental, Delta Dental, Guardian Direct, and Cigna.

Humana Dental stands out for its cost-effectiveness and customer service. Customers have reported significant savings and convenient features like free medication delivery. However, some have faced challenges in finding an appropriate dental office within their network, leading to frustration and delayed care.

Delta Dental has been praised for its value and seamless coverage, which includes efficient claims processing and comprehensive coverage for various dental procedures. Nonetheless, some users have encountered difficulties with billing disputes and customer service, highlighting the importance of clear communication and understanding of coverage details.

Guardian Direct is noted for its affordable plans with strong benefits, a large network of dentists, and a straightforward claims process. The insurer covers preventive care completely, significantly reducing out-of-pocket costs for major procedures. However, issues like the absence of physical insurance cards have caused inconvenience to some, underscoring the need for modern and user-friendly administrative processes.

Cigna offers affordable options with comprehensive coverage, including 100% coverage for preventive care. The plan's affordability is a strong point, particularly for families. However, coverage disputes and lack of transparency in customer service have been significant pain points, leading to frustration and regret for some policyholders.

In conclusion, when selecting dental insurance, it's essential to weigh factors such as cost, coverage details, network size, customer service quality, and ease of claims processing. Personal experiences may vary, so it's advisable to research extensively and consider your specific dental needs and budget constraints. Reading customer reviews and understanding the terms of the policy thoroughly can guide you in making an informed decision that best suits your dental care requirements.

free&low-cost dental clinics

View Now

dental health

Dental Implants

Dental Implants

How Can I Get Government Grants for Dental Implants?

Dental implants are a sought-after solution for missing teeth, offering a long-term fix that can significantly improve quality of life. However, the cost of dental implants can be prohibitive for many. Understanding government programs and other grants available for dental care, particularly dental implants, can help bridge this financial gap. In this guide, we will walk you through some government assistance and grant programs aimed at making dental implants more accessible.

Dental Implants

How to get free dental implants?

When it comes to dental implants, the cost can sometimes make you clench your teeth harder than the cold does. But fear not! There are a plethora of avenues to explore for low-cost or even free dental care. From state and local resources to dental schools and community health centers, let’s dive into where you can find that much-needed dental implants without breaking the bank.

Dental Implants

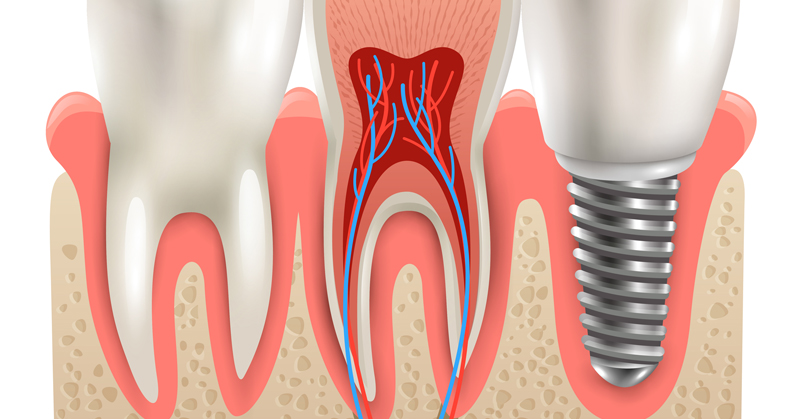

What Are the Possible Risk Or Side Effects for Dental Implants?

Dental implants provide an excellent way to replace missing teeth and restore your smile. But as with any medical procedure, there are possible risks and side effects to consider before undergoing implant surgery. In this article, we aim to provide a comprehensive overview of dental implants - what they are, who is a suitable candidate, and most importantly, the potential risks and complications that can arise. By understanding both the benefits and possible downsides of implants, you can make a fully informed decision about whether they are the right choice for your individual needs and health profile.

Dental Implants

How to Get Your All-On-4 Dental Implants Without Breaking the Bank

In the United States, the cost of All-On-4 dental implants can vary significantly depending on your location. For instance, the cost in different states ranges from around $12,000 to $39,200 per arch. When seeking affordable options domestically, it's important to explore various clinics and compare their pricing. Additionally, some dental practices might offer flexible payment plans or dental loans to help manage the costs.

Dental Implants

Will Your Insurance Cover Dental Implants?

Dental implants are growing in popularity, with over 3 million Americans choosing them to replace missing teeth. While implants fuse securely into the jawbone providing natural-looking and long-lasting tooth replacements, the process does come with a hefty price tag. On average, a single implant can cost $1,600-$2,200 out of pocket. For patients needing multiple implants or other restorative work, these expenses quickly add up.