How to Get Your All-On-4 Dental Implants Without Breaking the Bank

In the United States, the cost of All-On-4 dental implants can vary significantly depending on your location. For instance, the cost in different states ranges from around $12,000 to $39,200 per arch. When seeking affordable options domestically, it's important to explore various clinics and compare their pricing. Additionally, some dental practices might offer flexible payment plans or dental loans to help manage the costs.free and low-cost dental care in University Center

Securing funding for dental implants can be challenging, especially with the high costs associated with the procedure. However, several options are available to help cover these costs in 2024. This guide explores various funding sources and strategies to make dental implants more affordable.

1. Dental Insurance Plans

While most traditional dental insurance plans do not cover the full cost of dental implants, some plans are starting to offer partial coverage. It's essential to review your insurance policy or consider purchasing a plan that includes implant coverage. Here are a few tips:

-

Check if your dental insurance plan offers any coverage for implants, even if it's partial. Some plans may cover specific parts of the procedure, such as the crown or abutment.

-

Consider supplemental dental insurance plans that focus on major restorative care, which might include implants.

-

Look for plans that offer coverage for implant-related procedures, such as extractions and bone grafting.

-

2. Dental Discount Plans

Dental discount plans, also known as dental savings plans, provide a cost-effective alternative to traditional insurance. These plans offer significant discounts on dental procedures, including implants. Key points include:

-

DentalPlans.com: Offers a variety of discount plans that can reduce the cost of implants by 10-60%.

-

These plans typically have an annual fee but no waiting periods or annual caps.

-

3. Payment Plans and Financing Options

Many dental offices offer payment plans and financing options to help patients manage the cost of implants. These options may include:

-

CareCredit: A healthcare credit card that allows you to pay for dental procedures in monthly installments.

-

In-house financing plans offered by dental practices, often with low or no interest rates.

-

Personal loans from banks or credit unions, which can provide the necessary funds upfront with manageable repayment terms.

-

4. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are tax-advantaged accounts that can be used to pay for medical expenses, including dental implants. Here’s how they work:

-

HSA: Available to individuals with high-deductible health plans. Contributions are tax-deductible, and funds can be used for qualified medical expenses without penalty.

-

FSA: Allows you to set aside pre-tax dollars for medical expenses. Unlike HSAs, FSAs have a "use-it-or-lose-it" policy, so funds must be used within the plan year.

-

Check the list of affordable dental clinics near you

dental health

Dental Implants

Dental Implants

Why Are Implants So Expensive?

According to recent statistics, tooth loss is a prevalent issue, especially among older individuals. Adults between the ages of 20 to 64 have an average of 25.5 remaining teeth. However, factors such as age, smoking, lower income, and education level can contribute to a higher likelihood of tooth loss. In this article, we will explore dental implants in detail through the following aspects:

Dental Implants

How Painful is Dental Implant Surgery?

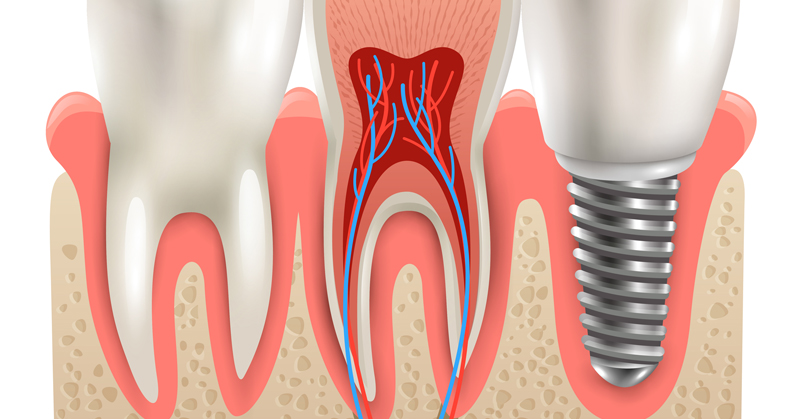

If you are missing teeth due to decay, injury, or gum disease, dental implants offer an effective and natural-looking replacement option. Unlike removable dentures that can slip, implants fuse securely into your jawbone for permanent stability. They also help preserve bone and support surrounding teeth better than bridges or dentures. But most patients wonder - how painful are implants? The procedure does involve surgery and recovery time.

Dental Implants

How to Find Dental Implants for Low Income

Dental implants are popular and effective solutions for replacing missing teeth. However, they can be quite expensive. For instance, one single implant can cost about $1500 in the US.If you're looking for ways to make dental implants more affordable, this article will provide you with five practical strategies to save on cost.

Dental Implants

Do You Know All These Different Types of Implants?

In the field of dentistry, dental implants have revolutionized the way we approach tooth replacement. With their durability, functionality, and aesthetic appeal, dental implants have become the go-to solution for individuals with missing teeth. However, not all dental implants are created equal. There are various types of dental implants, each with its own unique characteristics and applications. In this comprehensive guide, we will explore the different types of dental implants and the techniques used for their placement.

Dental Implants

Will Your Insurance Cover Dental Implants?

Dental implants are growing in popularity, with over 3 million Americans choosing them to replace missing teeth. While implants fuse securely into the jawbone providing natural-looking and long-lasting tooth replacements, the process does come with a hefty price tag. On average, a single implant can cost $1,600-$2,200 out of pocket. For patients needing multiple implants or other restorative work, these expenses quickly add up.