Does Medicare Cover Dental Implants in 2024?

Medicare is an essential service for seniors, covering critical aspects of healthcare such as hospital stays, hospice care, and doctor services. However, when it comes to dental implants, a procedure known for its high costs, many beneficiaries find themselves questioning their coverage options. If you're contemplating this procedure, it's vital to know whether your plan offers coverage. This article aims to shed light on the coverage of dental implants under Medicare, focusing on Medicare Advantage plans.What Is Dental Indemnity Plans?

updated on November 15, 2023

Dental insurance helps cover predictable routine costs like exams and cleanings, as well as unpredictable expensive treatments. Employer-sponsored plans offer perks like subsidies, tax benefits, and pooled risk. While dental insurance can provide valuable financial assistance, the variety of plan options can make choosing coverage confusing. The aim of this article is to explain what indemnity dental insurance is and how it works, so you can determine if this type of plan makes sense for your needs. We’ll provide an overview of indemnity dental plans, how reimbursement and fees work, the pros and cons to consider, and how indemnity compares to other dental insurance options.

Indemnity dental insurance, also known as traditional dental insurance, is one type of plan to consider. With indemnity plans, you pay a monthly premium and are reimbursed a fixed amount for dental expenses based on what your insurance carrier determines to be “usual, customary, and reasonable” fees. A key benefit is flexibility—you can visit any licensed dentist without a referral. However, out-of-pocket costs may be higher depending on the dentist's fees. Understanding how indemnity dental plans work is important for anyone aiming to offset the expense of dental treatment.

How Indemnity Plans Operate:

Indemnity dental insurance provides coverage that works differently than other common insurance plans like Dental PPOs and Dental HMOs. With indemnity dental plans, you are not restricted to a network of dentists - this flexibility allows you to visit any licensed dentist you choose without needing a referral.

Indemnity plans reimburse you for a percentage of your dental expenses, up to a maximum amount deemed "usual and customary" by your insurance company. If your dentist charges more than the usual and customary rate set by your insurer, you are responsible for paying the remainder of the bill out of pocket.

Like other types of dental insurance, indemnity plans typically involve several key components:

-

An annual deductible, which is the amount you must pay out-of-pocket before your insurance coverage kicks in. For example, if your deductible is $75, you would need to pay the first $75 of dental expenses before insurance starts covering a percentage of costs.

-

Monthly or yearly premiums that must be paid to keep your policy active. Premiums for indemnity dental plans often range from $400 to $700 annually.

-

An annual maximum benefit, which is the total dollar amount your plan will pay toward your dental care per policy year. Common max benefits may be around $1,000-$1,500.

-

Potential waiting periods for major dental work, which means you need to be enrolled for 6 months to a year before coverage for crowns, bridges, dentures and other major services starts.

Indemnity plans provide a percentage of coverage for preventive, basic, and major dental services. Covered services typically include:

-

Preventive: oral exams, cleanings, x-rays.

-

Basic: fillings, tooth extractions, some simple oral surgery.

-

Major: crowns, bridges, dentures, dental implants, root canals.

-

Weighing the Pros and Cons:

When weighing whether to enroll in a dental indemnity plan, there are some key advantages and potential drawbacks to consider.

One of the biggest pros of indemnity dental coverage is the flexibility it provides in choosing any dentist you want. You are not restricted to a limited network of providers. This appeals to many insurance shoppers who wish to continue seeing their current, trusted dentist. Indemnity plans also allow you to directly access specialists like orthodontists or oral surgeons without needing referrals from a primary care dentist. This freedom and flexibility is a major benefit for those who value having options in who provides their dental care.

However, with increased choice comes some potential trade-offs. Premiums for indemnity dental plans tend to be higher compared to other insurance options like Dental HMOs and Dental PPOs. So you'll want to factor the monthly or yearly costs into your decision. Indemnity plans also set maximum allowances that they will cover for each procedure, based on what is deemed the "usual, customary, and reasonable" rate. If your dentist's fees exceed that amount, you'll be responsible for paying the remainder. These plans also commonly have an annual maximum benefit, after which you must pay all remaining costs for the year. Being aware of out-of-pocket expenses is important.

As we've discussed, indemnity dental plans provide coverage that differs from dental HMOs and PPOs in several key ways. Speaking with your dentist on typical costs and clearly understanding annual maximums, deductibles, and reimbursement levels is key to picking coverage that fits your dental and financial needs.

free&low-cost dental clinics

View Now

dental health

Dental Implants

Dental Implants

How to Get Your All-On-4 Dental Implants Without Breaking the Bank

In the United States, the cost of All-On-4 dental implants can vary significantly depending on your location. For instance, the cost in different states ranges from around $12,000 to $39,200 per arch. When seeking affordable options domestically, it's important to explore various clinics and compare their pricing. Additionally, some dental practices might offer flexible payment plans or dental loans to help manage the costs.

Dental Implants

Will Your Insurance Cover Dental Implants?

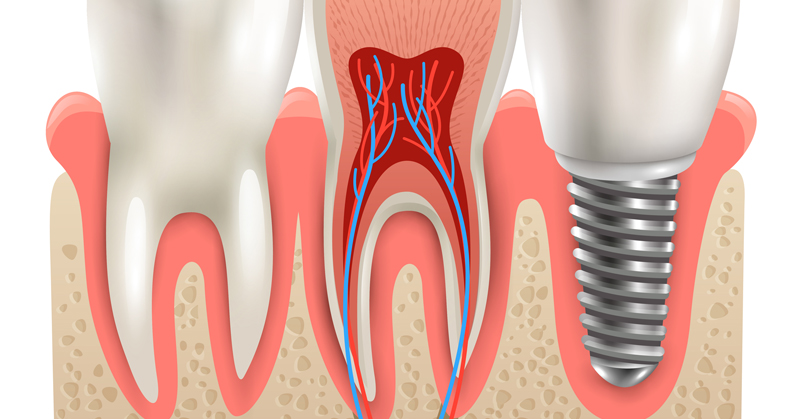

Dental implants are growing in popularity, with over 3 million Americans choosing them to replace missing teeth. While implants fuse securely into the jawbone providing natural-looking and long-lasting tooth replacements, the process does come with a hefty price tag. On average, a single implant can cost $1,600-$2,200 out of pocket. For patients needing multiple implants or other restorative work, these expenses quickly add up.

Dental Implants

How Can I Get Government Grants for Dental Implants?

Dental implants are a sought-after solution for missing teeth, offering a long-term fix that can significantly improve quality of life. However, the cost of dental implants can be prohibitive for many. Understanding government programs and other grants available for dental care, particularly dental implants, can help bridge this financial gap. In this guide, we will walk you through some government assistance and grant programs aimed at making dental implants more accessible.

Dental Implants

Top Dental Implant Brands in the United States

When it comes to dental implants, finding a reputable and reliable dental implant service is crucial. Dental implants are a popular and effective solution for replacing missing teeth, providing individuals with improved aesthetics, functionality, and oral health.With the increase in demand for dental implants, numerous brands have emerged, providing a variety of options to meet the diverse needs and budgets of patients. Choosing the right dental implant brand is vital as it directly affects the success and longevity of the dental implant procedure. In this article, we will explore some of the top dental implant brands in the United States, known for their expertise, advanced technology, and exceptional patient care.

Dental Implants

How to get free dental implants?

When it comes to dental implants, the cost can sometimes make you clench your teeth harder than the cold does. But fear not! There are a plethora of avenues to explore for low-cost or even free dental care. From state and local resources to dental schools and community health centers, let’s dive into where you can find that much-needed dental implants without breaking the bank.