Does Medicare Cover Dental Implants in 2024?

Medicare is an essential service for seniors, covering critical aspects of healthcare such as hospital stays, hospice care, and doctor services. However, when it comes to dental implants, a procedure known for its high costs, many beneficiaries find themselves questioning their coverage options. If you're contemplating this procedure, it's vital to know whether your plan offers coverage. This article aims to shed light on the coverage of dental implants under Medicare, focusing on Medicare Advantage plans.Does Medicare Cover Dental Implants in 2024?

updated on February 26, 2024

Medicare is an essential service for seniors, covering critical aspects of healthcare such as hospital stays, hospice care, and doctor services. However, when it comes to dental implants, a procedure known for its high costs, many beneficiaries find themselves questioning their coverage options. If you're contemplating this procedure, it's vital to know whether your plan offers coverage. This article aims to shed light on the coverage of dental implants under Medicare, focusing on Medicare Advantage plans.

Medicare and Dental Coverage Basics

Medicare Part A (Hospital Insurance): This primarily covers hospital stays and inpatient care. It does not cover any dental services, including implants. This includes even medically necessary procedures like jaw reconstruction after an accident, unless performed during a hospital stay.

Medicare Part B (Medical Insurance): While Part B covers some medically necessary services, it excludes routine dental care like fillings, cleanings, dentures, and, of course, implants. Even if the implant is deemed medically necessary (e.g., for speech or eating), Part B typically only covers the surgical portion of the procedure, not the implant itself.

Medicare Advantage (Part C): These plans provide all of your Part A and Part B benefits and often include additional benefits not covered by Original Medicare, such as vision, hearing, and dental care.

How Do Medicare Advantage Plans Cover Dental Benefits?

How it Works: Medicare Advantage plans offered by private insurance companies can include additional benefits like dental coverage. However, coverage varies significantly between plans, and implants are often not included. Some plans might only cover a portion of the implant cost, like a specific percentage or a fixed dollar amount. Others might offer discounts or networks of preferred providers with reduced rates.

Example: For instance, UnitedHealthcare's AARP Medicare Advantage plan F2 in Florida offers a $1,500 annual allowance for dental services, which could contribute to some of the implant cost depending on the plan's specific terms and your individual needs.

Cost Considerations: The costs associated with Medicare Advantage plans, including those with dental coverage, can vary widely. Premiums, deductibles, copayments, and coinsurance rates differ based on the specific plan, coverage options, and provider network. Beneficiaries should thoroughly review a plan's summary of benefits, paying special attention to dental coverage specifics, to understand their potential out-of-pocket costs for dental implants.

Exploring Alternatives for Dental Implant Coverage:

1. Supplemental Dental Insurance:How it Works: Standalone dental insurance plans can be purchased to fill the gaps in Medicare coverage. These plans often provide coverage for implants, but costs and coverage specifics vary significantly. Some plans might have annual or lifetime maximums for implant coverage, while others might require you to meet a deductible before coverage kicks in.

Example: A Cigna Dental Choice PPO plan might cover 50% of the cost of an implant after a $250 deductible, with an annual maximum of $1,500 for implants.

Cost Considerations: Premiums for supplemental dental insurance can vary depending on your age, location, and desired coverage level. Carefully compare plans and their specific implant coverage details before purchasing.

2. Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs):

How it Works: These tax-advantaged accounts allow you to set aside pre-tax dollars for qualified medical expenses, including dental care. Implants can qualify under certain conditions, but specific rules and limitations apply. For example, HSAs require you to have a high-deductible health plan (HDHP) to be eligible.

Cost Considerations: FSAs have annual contribution limits, and any unused funds are forfeited at the end of the year. HSAs offer more flexibility in carrying over unused funds, but they require careful planning and coordination with your HDHP qualifications.

Conclusion:

For Medicare beneficiaries considering dental implants, Medicare Advantage plans may offer a viable solution to manage the procedure's high costs. It's imperative to research and compare plans, focusing on dental coverage details, to find a plan that aligns with your healthcare needs and financial situation. Understanding your coverage options is the first step toward making an informed decision about dental implants and ensuring your dental health needs are met affordably.

free&low-cost dental clinics

View Now

dental health

Dental Implants

Dental Implants

Do You Know All These Different Types of Implants?

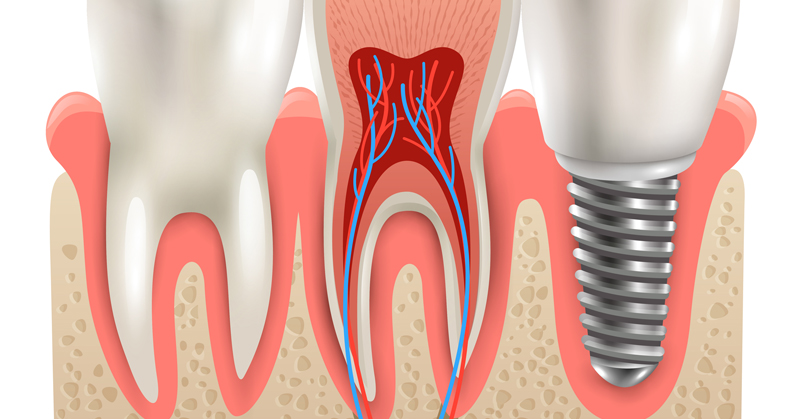

In the field of dentistry, dental implants have revolutionized the way we approach tooth replacement. With their durability, functionality, and aesthetic appeal, dental implants have become the go-to solution for individuals with missing teeth. However, not all dental implants are created equal. There are various types of dental implants, each with its own unique characteristics and applications. In this comprehensive guide, we will explore the different types of dental implants and the techniques used for their placement.

Dental Implants

How Painful is Dental Implant Surgery?

If you are missing teeth due to decay, injury, or gum disease, dental implants offer an effective and natural-looking replacement option. Unlike removable dentures that can slip, implants fuse securely into your jawbone for permanent stability. They also help preserve bone and support surrounding teeth better than bridges or dentures. But most patients wonder - how painful are implants? The procedure does involve surgery and recovery time.

Dental Implants

What Are the Possible Risk Or Side Effects for Dental Implants?

Dental implants provide an excellent way to replace missing teeth and restore your smile. But as with any medical procedure, there are possible risks and side effects to consider before undergoing implant surgery. In this article, we aim to provide a comprehensive overview of dental implants - what they are, who is a suitable candidate, and most importantly, the potential risks and complications that can arise. By understanding both the benefits and possible downsides of implants, you can make a fully informed decision about whether they are the right choice for your individual needs and health profile.

Dental Implants

Why Are Implants So Expensive?

According to recent statistics, tooth loss is a prevalent issue, especially among older individuals. Adults between the ages of 20 to 64 have an average of 25.5 remaining teeth. However, factors such as age, smoking, lower income, and education level can contribute to a higher likelihood of tooth loss. In this article, we will explore dental implants in detail through the following aspects:

Dental Implants

Will Your Insurance Cover Dental Implants?

Dental implants are growing in popularity, with over 3 million Americans choosing them to replace missing teeth. While implants fuse securely into the jawbone providing natural-looking and long-lasting tooth replacements, the process does come with a hefty price tag. On average, a single implant can cost $1,600-$2,200 out of pocket. For patients needing multiple implants or other restorative work, these expenses quickly add up.