Does Medicare Cover Dental Implants in 2024?

Medicare is an essential service for seniors, covering critical aspects of healthcare such as hospital stays, hospice care, and doctor services. However, when it comes to dental implants, a procedure known for its high costs, many beneficiaries find themselves questioning their coverage options. If you're contemplating this procedure, it's vital to know whether your plan offers coverage. This article aims to shed light on the coverage of dental implants under Medicare, focusing on Medicare Advantage plans.Are Braces Covered by Dental Insurance?

updated on November 15, 2023

Currently, a staggering 3.9 million individuals in the United States are weraing braces —a testament to the enduring popularity of orthodontic treatment. Among this vast sea of brace wearers, one in four happens to be an adult, showcasing that braces are not just a rite of passage for the younger generation. However, the pursuit of that flawless grin comes at a considerable price, with braces often ringing in at thousands of dollars. The good news? Some dental insurance plans may cover part of the cost. In this article, we will examine the types of braces that may be covered, the financial realities of braces with and without insurance, and tips for saving on your orthodontic treatment.

Overview of Dental Braces Potentially Covered By Insurance :

Orthodontic treatment with braces can be expensive, often ranging anywhere from $3,000-$8,000 depending on the type. This high cost prevents many adults and families from getting needed orthodontic care. Understanding what brace options exist and whether insurance may help offset costs is important. Here are some common types of braces and their typical costs:

-

Traditional metal braces remain the most common and affordable option, with costs typically ranging from $3,000-$6,000. Metal brackets are bonded to each tooth and connected by a metal archwire that applies pressure to shift teeth into proper alignment.

-

Ceramic braces offer a more discrete aesthetic, with tooth-colored or clear brackets instead of metal. This stylistic appeal comes at a higher cost, usually between $4,000-$8,000. The archwires connecting brackets can also be matched to teeth for minimal visibility.

-

Strategies for Reducing Your Braces Costs

Orthodontic treatment is a major investment, often totaling thousands of dollars even with dental insurance. If your policy does not fully cover braces, there are multiple strategies you can leverage to lower your out-of-pocket costs:

-

Do your homework on insurance benefits. Before starting any treatment, verify that your orthodontic coverage is active, with no waiting periods. Understand any age limitations, copays, or annual maximums that may impact coverage. Get benefit estimates in writing so there are no surprises.

-

Compare orthodontist pricing and financing plans. Most orthodontists offer interest-free payment plans to spread out costs over 12-24 months. Shop around for best pricing packages and terms from several offices. Ask about discounts for paying cash upfront.

-

Consider dental schools. Orthodontics students provide treatment under expert faculty supervision at dental schools. This can reduce costs by 20-50% compared to private practice. Quality of care remains high.

-

Enroll in dental savings plans. Companies like United Concordia offer savings plans with 10-60% off orthodontic treatments. Compare plans at different monthly/annual price points to maximize value.

-

Check for financial assistance programs. Local health clinics or nonprofit groups may offer low-cost braces or orthodontic care for those who qualify based on financial need. This provides huge cost savings.

-

Explore financing options carefully. Dental loans or credit cards with 12-18 month no interest periods allow you to finance orthodontics over time. Compare interest rates and terms before committing.

-

Ask your dentist about cost-saving alternatives. Options like clear aligners on just top or bottom teeth, or metal braces on just front teeth, can reduce costs. Payment plans over 6-12 months allow you to budget monthly costs.

With upfront planning and research, you can uncover savings that make braces more affordable if dental insurance does not pick up the full tab. Prioritize your orthodontic health, but also take proactive steps to keep treatment reasonably priced based on your budget and needs.

-

-

Lingual braces attach to the back of teeth rather than the front surfaces. This makes them nearly invisible as they face the tongue. But the complex customization pushes costs for lingual braces between $5,000-$10,000.

-

Removable clear aligner systems like Invisalign offer an alternative to fixed braces. A series of clear plastic trays are worn to gradually move teeth. Total costs for clear aligners are commonly $3,500-$5,000.

Some dental insurance plans cover orthodontic treatment, which can offset costs. Typical coverage ranges from 30-50% for children and adults. With 50% coverage, metal braces may cost $1,500-$3,000 out of pocket, while clear aligners could be $1,750-$2,500. However, coverage varies widely based on the insurer, specific plan details, annual maximums, deductibles, and copays.

Traditional braces tend to be the most affordable option, while clear or lingual braces provide aesthetic appeal at a higher price. Insurance coverage can reduce costs significantly, but benefits, age limits, and cost-sharing amounts differ between providers.

-

Strategies for Reducing Your Braces Costs

Orthodontic treatment is a major investment, often totaling thousands of dollars even with dental insurance. If your policy does not fully cover braces, there are multiple strategies you can leverage to lower your out-of-pocket costs:

-

Do your homework on insurance benefits. Before starting any treatment, verify that your orthodontic coverage is active, with no waiting periods. Understand any age limitations, copays, or annual maximums that may impact coverage. Get benefit estimates in writing so there are no surprises.

-

Compare orthodontist pricing and financing plans. Most orthodontists offer interest-free payment plans to spread out costs over 12-24 months. Shop around for best pricing packages and terms from several offices. Ask about discounts for paying cash upfront.

-

Consider dental schools. Orthodontics students provide treatment under expert faculty supervision at dental schools. This can reduce costs by 20-50% compared to private practice. Quality of care remains high.

-

Enroll in dental savings plans. Companies like United Concordia offer savings plans with 10-60% off orthodontic treatments. Compare plans at different monthly/annual price points to maximize value.

-

-

Check for financial assistance programs. Local health clinics or nonprofit groups may offer low-cost braces or orthodontic care for those who qualify based on financial need. This provides huge cost savings.

-

Explore financing options carefully. Dental loans or credit cards with 12-18 month no interest periods allow you to finance orthodontics over time. Compare interest rates and terms before committing.

-

Ask your dentist about cost-saving alternatives. Options like clear aligners on just top or bottom teeth, or metal braces on just front teeth, can reduce costs. Payment plans over 6-12 months allow you to budget monthly costs.

With upfront planning and research, you can uncover savings that make braces more affordable if dental insurance does not pick up the full tab. Prioritize your orthodontic health, but also take proactive steps to keep treatment reasonably priced based on your budget and needs.

-

free&low-cost dental clinics

View Now

dental health

Dental Implants

Dental Implants

Do You Know All These Different Types of Implants?

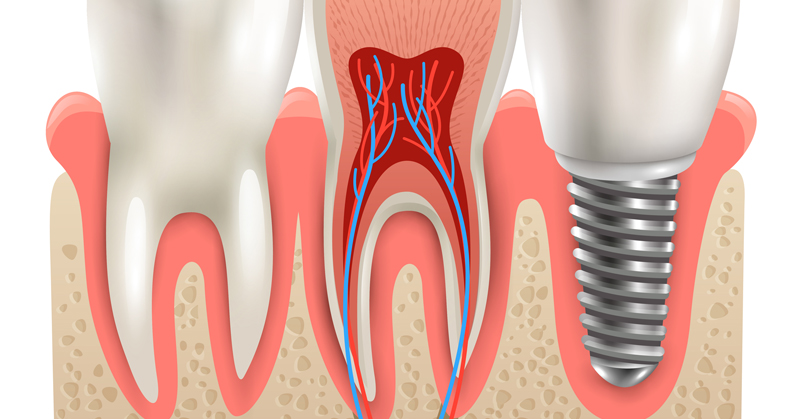

In the field of dentistry, dental implants have revolutionized the way we approach tooth replacement. With their durability, functionality, and aesthetic appeal, dental implants have become the go-to solution for individuals with missing teeth. However, not all dental implants are created equal. There are various types of dental implants, each with its own unique characteristics and applications. In this comprehensive guide, we will explore the different types of dental implants and the techniques used for their placement.

Dental Implants

How to Get Your All-On-4 Dental Implants Without Breaking the Bank

In the United States, the cost of All-On-4 dental implants can vary significantly depending on your location. For instance, the cost in different states ranges from around $12,000 to $39,200 per arch. When seeking affordable options domestically, it's important to explore various clinics and compare their pricing. Additionally, some dental practices might offer flexible payment plans or dental loans to help manage the costs.

Dental Implants

Why Are Implants So Expensive?

According to recent statistics, tooth loss is a prevalent issue, especially among older individuals. Adults between the ages of 20 to 64 have an average of 25.5 remaining teeth. However, factors such as age, smoking, lower income, and education level can contribute to a higher likelihood of tooth loss. In this article, we will explore dental implants in detail through the following aspects:

Dental Implants

Will Your Insurance Cover Dental Implants?

Dental implants are growing in popularity, with over 3 million Americans choosing them to replace missing teeth. While implants fuse securely into the jawbone providing natural-looking and long-lasting tooth replacements, the process does come with a hefty price tag. On average, a single implant can cost $1,600-$2,200 out of pocket. For patients needing multiple implants or other restorative work, these expenses quickly add up.

Dental Implants

What Are the Possible Risk Or Side Effects for Dental Implants?

Dental implants provide an excellent way to replace missing teeth and restore your smile. But as with any medical procedure, there are possible risks and side effects to consider before undergoing implant surgery. In this article, we aim to provide a comprehensive overview of dental implants - what they are, who is a suitable candidate, and most importantly, the potential risks and complications that can arise. By understanding both the benefits and possible downsides of implants, you can make a fully informed decision about whether they are the right choice for your individual needs and health profile.